In the state of Florida, it’s a crime to drive a car without minimum coverage. But that doesn’t exactly help your injuries if you’re rear-ended at a red light by an uninsured motorist. If you’re struck by an uninsured motorist, you can still make a claim with your insurance company. Ultimately, the uninsured driver is responsible for any additional damages.

There’s no question that a driver’s failure to carry insurance can complicate your ability to make a full and fair recovery. The car accident lawyers at Long, Jean & Weschler, P.A. can review your coverages and the coverage of the other driver. If you have a viable case, we will represent you on a contingency basis. Call today for a free, no-obligation consultation.

What is Minimum Coverage in Florida?

In order to drive a car in Florida, you must have the following coverages:

$10,000 in Personal Injury Protection (PIP)

This provided medical care for anyone inside the covered vehicle. It covers 80% of your medical expenses and 60% of your lost wages up to the limits of the policy. For example, suppose you are injured in a car accident. Your medical bills amount to $5,000, and you lose $1,000 in wages. A minimum PIP policy would reimburse you up to $4,600.

$10,000 in Property Damage Liability (PDL)

This required coverage compensates the owners of other vehicles and property that you damage in an accident. It does not cover your vehicle. If you want to protect your own vehicle against damage that you cause, you’ll have to purchase a collision policy.

Many drivers in Florida wisely elect to carry additional insurance and set their PIP and PDL limits much higher. When you think about it, even a moderate accident can result in much more than $10,000 in damages. If you’re responsible for someone else’s injuries, their attorneys can pursue your personal assets if your coverage is insufficient.

Most insurance companies recommend a comprehensive plan that includes:

Bodily Injury Liability (BIL)

This covers another person’s injuries if you’re responsible or partially responsible for an accident. Without this coverage, if you injure someone in an accident, they could pursue you for damages. Florida does not require BIL insurance, but not carrying it can have severe consequences.

Uninsured/Underinsured Motorist Coverage

If you are injured by an uninsured motorist or a motorist who has insufficient Bodily Liability Insurance to cover your damages, this policy will pay up to the limit that you purchase.

Car Rental Insurance

Many drivers opt for this type of insurance. If your car is damaged, the insurance company pays for a rental vehicle or a portion of the rental, depending on the vehicle you opt for.

Uninsured Motorist Statistics for Florida

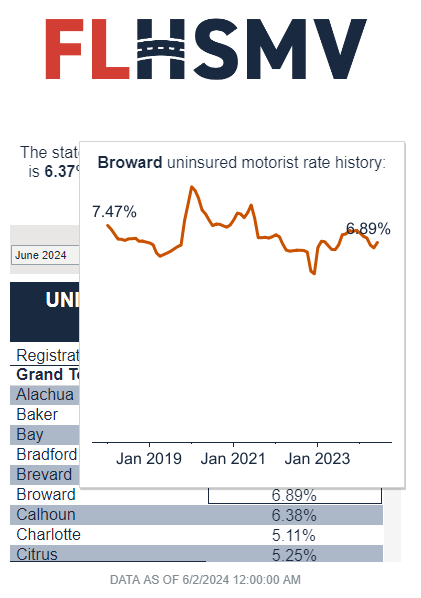

According to the FLHSMV, the rate of uninsured motorists in the state of Florida is 5.38%, with Broward being slightly higher at 5.81%. However, the Insurance Information Institute claims that the uninsured and underinsured motorist rate is about 15.9%. That means that there is about a one-in-seven chance that your accident will involve an uninsured motorist.

Image via Florida Department of Highway Safety and Motor Vehicles

What Happens if the Other Driver is Uninsured?

You may not realize that another driver is uninsured at the scene of an accident. For example, they may claim to have left their insurance card at home or present a card for a lapsed policy. If you have had an accident with a driver who admits that they don’t have insurance, let the police officer completing the report know. The officer may opt to issue an additional citation for failure to carry proof of insurance.

If you learn that another driver is uninsured, you can still make a claim with your own insurance company. Your insurance will cover some aspects of the accident, regardless of whether the other driver is insured.

In order to pursue damages from an uninsured or underinsured driver, you may have to sue. This will not always be a good option for you, however. One of the most common reasons that drivers fail to carry insurance is that they don’t have the money for it. That may mean that they have little in the way of assets.

If you’re successful, you may end up with a sizeable judgment that the defendant can never pay. This in no way means that you should refrain from pursuing damages. There are many avenues that an experienced accident lawyer can take to get you the compensation you have coming to you.

Steps to Take After Being Hit By an Uninsured or Underinsured Driver

In many ways, being struck by an uninsured driver is like being hit by someone who is properly insured. Follow these steps after an accident to protect your physical safety and any future claims.

While on the Accident Scene

- Get to a place of safety. Move your vehicle to a safe area if it will run. If you are in danger waiting in your car, carefully get out and move from the roadway.

- Call first responders to the scene. The dispatcher will want to know your exact location, a description of the vehicles, any injuries, etc. If you don’t know where you’re located, look for signs or a business that you can provide for them.

- Watch the other driver’s behavior. Not having insurance may give the other driver an incentive to leave the scene. If you are able to, take a picture of their car and license plate.

- Photograph the scene. Your pictures should include signs or road markings, damage to the vehicles, visible injuries, license plates, debris on the roadway, etc.

- Allow first responders to examine you. Your first priority is your health and safety. You should not avoid emergency care because you’re worried about the medical bills. Even if you carry minimal insurance and the other driver doesn’t have any, you will still be partially covered. This step is also essential to collect a full settlement.

- Talk to witnesses who may have seen what happened. If they refuse to wait for the police to arrive, ask them for their contact information. Ask the other driver for their insurance information. If they don’t have an insurance card or they admit to being uninsured, refrain from being confrontational. Relay the information to the police.

- Ask the responding officer for a case card or driver’s exchange form.

After You Leave the Scene

- If you were not transported to the hospital, follow up with your own doctor. Let them know you were in an accident and ask for a full examination.

- If the other driver doesn’t have insurance, contact your own insurance company. Provide them with basic information about the accident and let them know the other driver doesn’t have insurance. This is a good time to review your insurance policy with the claim’s agent. They can inform you about the limits of your policy so you know the extent of coverage.

- Call a personal injury lawyer. Not all car accident attorneys handle uninsured motorist claims. Let them know that you believe you’re dealing with an underinsured or uninsured motorist. In Broward County, Pompano’s LJW law firm will review your case and help you negotiate with the insurance companies. Additionally, they can determine whether or not it’s worth pursuing the uninsured driver for additional damages.

Legal Concepts That Apply to Uninsured Motorist Cases

If an uninsured driver has injured you, it might be helpful to understand the laws that will affect your case. This section provides a brief overview of the legal concepts that can impact your case.

Civil Liability vs. Criminal Law

Operating a vehicle without insurance is illegal and can result in fines and driver’s license suspension. Unless it’s a recurring issue, the driver will usually not face jail time. In the case of an accident, the courts will also require the driver to make restitution for the damages they incurred before restoring their license.

In order to recover damages, many accident injury victims have to pursue compensation through litigation. This involves a personal injury attorney filing a lawsuit through the Broward civil court system and taking the defendant to trial. Most lawyers will only consider litigation if the case is viable and the defendant has assets that would make a lawsuit worthwhile.

Four Elements of Liability

Whether a defendant has adequate insurance or is without coverage, a personal injury lawyer has to prove that the following four elements exist. We can demonstrate these elements with an example. Consider a truck accident in which a semi-truck runs a red light, striking a car and causing injuries.

- Duty of Care – This means that the defendant had a duty of care for the plaintiff. In the example of the semi-truck accident, both parties have a duty of care for each other. In fact, all vehicle operators have a duty of care for all persons they might encounter on the roadways.

- Breach of Duty – The second element occurs when the defendant fails to live up to their legal duty of care. In the truck example, the driver runs a red light. This would be a breach of their duty of care since they were legally obligated to stop.

- Causation – This means that the defendant’s breach of duty caused the accident or was at least partially responsible. In the truck accident example, the driver’s failure to stop at the red light was the reason that the accident happened. It’s important to note that you can still recover damages, even if you were at fault. We’ll discuss this more in the next section.

- Damages – In order for a case to be actionable, the plaintiff must be able to show damages. Accidents with injuries always involve damages. Damages can be monetary (i.e., medical bills, lost wages, and property damage) or intangible (pain and suffering). One would assume that a car struck by a semi-truck would involve injuries. It’s the role of the personal injury lawyer to determine the total amount of damage and negotiate for a comprehensive settlement.

During your initial free consultation at Long, Jean & Weschler, P.A., we will review your case to determine that all of the above elements exist. If you have a viable case, we can represent you on a contingency basis. You’ll never pay out of pocket for our professional legal advice.

Florida’s Comparative Negligence Law

Under Florida’s comparative negligence law, you can still collect damages if you were involved in an accident, even if you were partially at fault. The damages you can collect are inversely proportionate to your degree of fault. For example, consider a motorcycle accident where a car driver sideswipes the bike. If the motorcyclist was found to be going 10 mph over the speed limit, that violation may have contributed to their injuries. Under these circumstances, the parties may determine that the car driver was 85% responsible for the accident and the rider was 15% responsible. Consequently, the plaintiff could collect 85% of their damages. If the total damages are $100,000, the plaintiff could receive $85,000.

Types of Damages

Personal injury law classifies damages in three ways:

- Economic Damages – These are the financial costs of an accident, including medical bills, lost wages, property damage, and more. Any financial cost associated with the accident is part of economic damages.

- Non-Economic Damages – These are often referred to as “pain and suffering” because they attempt to compensate the plaintiff for physical pain, emotional anguish, and inconvenience.

- Punitive Damages – In some instances, the actions of the defendant are considered so egregious that the court will award additional damages as a punishment.

There are no damage caps for economic and non-economic damages in the state of Florida. They are considered to be compensatory. Punitive damages are capped at three times the amount of compensatory damages or $500,000 — whichever amount is higher.

Statute of Limitations

For most accidents, Florida’s statute of limitations is four years from the date of the accident. In wrongful death actions, it’s two years from the date of the death. While this may seem like a significant amount of time, it’s important to involve the services of a personal injury lawyer as early as possible. Over time, evidence can be lost, witnesses forget details, and the case can be more difficult to prove. Additionally, uninsured motorist cases can take more time to prepare, so call today.

How LJW Legal Can Help

You may have filed a claim for property damage to your car, and it never occurred to you that you should call a lawyer. You probably got a check for your damage (minus your deductible), and it worked out fine. Injury accidents are completely different.

Injury accidents are much more complicated, and insurance companies will pull out all of the stops to minimize their payout. They may even proactively contact you before you file a claim. That’s because they know that your claim could substantially increase once you’re represented by an attorney. Even if you’re dealing with your own insurance company — which is probably the case with an uninsured motorist — you shouldn’t accept a settlement offer without speaking to a car accident attorney. If you’re in Broward County, FL, our Pompano Beach law firm can provide the following services for you on a contingency basis:

- Collect all evidence and documentation pertaining to your legal case

- Determine liability for the accident

- Find out if the defendant is covered by any policies that can assist with your damages

- Contact your insurance company on your behalf

- Determine whether an uninsured defendant has assets that are worth pursuing

- Issue letters of protection to your doctors so your medical treatment is not held up because of your finances

- File a lawsuit on your behalf

- Depose all witnesses, including the defendant

- Represent you in all court proceedings

- Negotiate with the insurance companies or defendant’s attorneys

- Examine all settlement offers

- Distribute funds to parties with claims on the settlement

When you choose LJW, you will know that you have a top litigation lawyer working on your case. Our attorneys work on a contingency basis, which means that we only receive payment if you get a settlement or win in court.

How Can I Protect Myself From Uninsured Motorists?

All major auto insurance companies offer uninsured motorist coverage. If you don’t have uninsured motorist coverage, we recommend that you add it to your policy. Additionally, if you carry the minimum Personal Injury Protection ($10,000), you should increase your coverage. These minimum policies will only cover your expenses for a minor injury. Contact your insurance company and ask how you can better protect yourself against uninsured motorists.

Pompano Beach Personal Injury Lawyers

If you’ve been in a car accident with an uninsured motorist, call Long, Jean & Weschler, P.A. for a free consultation and immediate representation.